Capitalizing Software Development Costs Ifrs Vs Gaap

FASB Accounting Standards Codification, U.S. GAAP, CPA Exam, CPA Examination, CPA Review, CPA Prep, IFRS, IAS, IASB, GAAP, FASB, AICPA, International Financial.

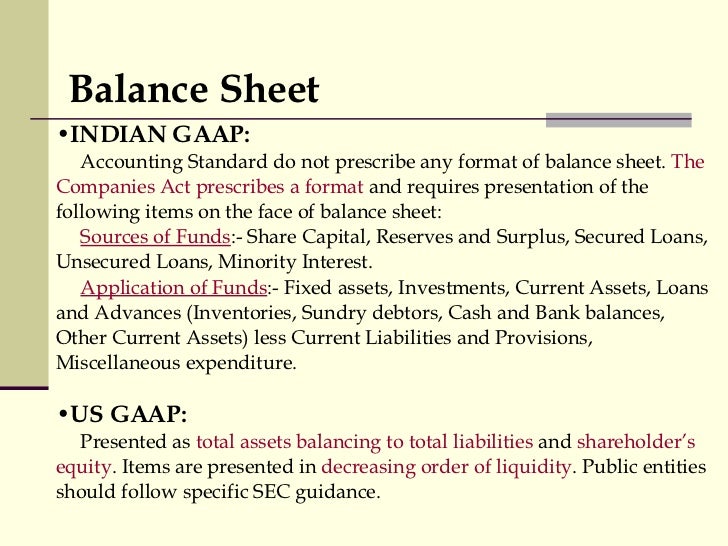

According to the Financial Accounting Standards Board, or FASB, generally accepted accounting principles, or GAAP, require that most research and development costs be. Generally Accepted Accounting Principles (GAAP) requires the capitalization of costs associated with the acquisition or construction of property, plant, and equipment. This post reviews the definition of research and development costs, how it is reported if conducted in-house, purchased, and from the perspective of a contract. Adobe Captivate 6 Download Crack Pes. The primary basis for GAAP accounting rules for capitalizing costs is the assumption that an asset or expenditure will realize benefits that extend through future years.

GAAP, Codification of Accounting Standards. U. S. GAAP Codification of Accounting Standards.

Capitalizing Expenses. When you capitalize an expense and then amortize the costs, you spread the cost over an extended period of time. Suppose you decide to amortize.